|

I have recently returned from an AFP Central New York luncheon, hearing a talk given by Bill Abrams (of Infinize), and my mind can’t stop spinning about what Bill said. Let me share with you a boiled down version of his message:

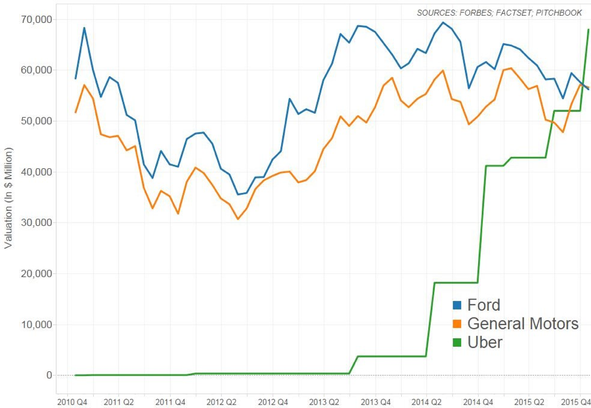

I interrupted Bill’s presentation to ask, “So, where will organizations’ major gifts prospects come from, then?” Bill answered that my local auto mechanic is much more likely to have as much income and wealth in the future as my banker does now – the Millionaire Next Door idea but cranked up several hundred RPMs. And that’s when I started trembling, because now the number of prospects that my clients need to cultivate through personalized, special attention has gone from the top 5% of their constituency to – well – everyone. And I imagined major gifts programs melting down into a huge, stratified, boundless annual giving program. This article shares my subsequent research along with some of Bill’s ideas to illustrate where this vision comes from. Costs and Incomes Are Dropping I don’t agree that the sharing economy is new. We’ve had centuries of families sharing assets -- such as the family car, the house, and the farm land -- for most of our existence. In addition, even celebrities like Carol Burnett participated in a sharing economy by living in a women’s dorm while she was building her career [1]. The difference is that we can share assets with strangers now. We don’t have to find people who are willing to give us a ride to the grocery store when our car is down – we can Uber over to the store or arrange for a Zip Car. So the efficiency of shared assets moves out of the family and into the entire world, and that is why Bill, in his presentation, showed us that neither the world’s largest taxi company (Uber), nor the world’s largest retailer (Alibaba), nor the world’s largest hotelier (Airbnb), nor the world’s largest media company (Facebook) has inventory. These companies offer information and access, not product. Since cars, living spaces, and content can all be shared, we now need fewer cars, fewer hotels, and fewer subscriptions to television channels (see this Bloomberg Technology article on who’s fighting over taking control of our TVs). After all, if I can pick up a ZipCar on my way to an Airbnb reservation, then I need neither my own car nor a hotel room. And that is a threat to the companies that make cars and run hotels, to say nothing of how live streaming has taken away the monopoly that cable television used to have on us. So our costs will get cheaper, but people who make cars, for instance, will also get thrown out of work. To illustrate this trend, Georgios Petropooulos’ article, “Uber and the Economic Impact of Sharing Economy Platforms,” shows a chart of Uber’s valuation overtaking the valuation of General Motors and Ford. This chart makes clear the impact of the sharing economy on our backbone manufacturing industry – cars. And then there’s the economist Robert Gordon, who, on an episode of Freakonomics Radio told us that “the Second Industrial Revolution was a one-time event.” He goes on to say that growth in the near future will not be as rapid as it was when Rockefeller brought light to homes and made his fortune, or when trains were invented and whole industries were created. [2] Gordon says that between 1870 and today, the standard of living has doubled, but forecasts our near future income growth to be 0.3 percent per year. Gordon says: “It means as many people will be falling back as those who are moving ahead.” [3] Gordon’s hypothesis was supported in early 2016 when the Bank of Japan adopted negative interest rates. You get paid to borrow and you pay interest to save (see this Bloomberg QuickTake article for an explanation). This action is seen as desperation by countries trying to stimulate growth. We have also seen many articles explaining how lower wage jobs (service industry jobs) have increased during our current recovery, and mid-and higher-wage jobs have disappeared (See this excellent article). Are we heading toward a world of the very rich and the very poor? Many economists say yes, we definitely are. Bill’s presentation seemed to argue with that assumption. Ultra-High Income Careers Will Dissipate Part of Bill’s presentation was on the FIRE economy (see here for a good definition), which stands for:

The Capgemeni World Wealth Report for 2016 predicts that financial services, high tech, and healthcare are the top three industries that will drive growth in the wealth of our world’s ultra-high net worth individuals. Bill’s presentation countered parts of that prediction when he discussed these new companies:

So We Suggest… Given this information, I can only wonder if an institution’s major gifts team, now working hard to solicit 95% of the organization’s gifts from 5% of its donors, will see a much more flattened prospect pool – more like a rectangle with strata of affinity and inclination rather than a pyramid with a narrow point at the top, representing the very few donors making the highest gifts. If the rising (or more democratic) tide raises all boats, though, I worry that fundraisers may drown in the subsequent high seas. After all, in a fundraising shop, money and effort is spent on the very top prospects. If a shop finds that many more individuals have wealth to make gifts than the staff is accustomed to soliciting, even at more moderate giving levels, then the staff have a new responsibility to cultivate all of them with the same personal care and attention. And how could that be done? Recently, the phenomenon of digital giving officers has emerged. Perhaps these professionals will recapture the attention of those whom we once called leadership annual giving prospects. Or perhaps many more constituents will be cultivated online. We have also experienced the disruption of new technology in our own profession. Like it or not, our audience is online more and more, and that means that our old pattern of calling prospects on the phone asking for an in-person visit, can no longer be our only method of personal cultivation. A recent Marketing Sherpa poll showed that people chose “phone call” as eighth among their preferred choices for hearing from a company, and e-mail was number one (see here). That preference held true across all age groups. Many prospects now should be cultivated via LinkedIn and other social media, meaning that our gift officers must have an online presence. And online communities are springing up, forcing organizations to join in the electronic conversation. A few years ago, I wondered where the next wave of new wealth would come from. I could not have thought that the wave of wealth would actually come from a wider segment of the current donor pool, and that wealth would be owned equally by both the hidden millionaire next door and the high-priced anesthesiologist on the other side of town. This is going to be interesting. What are your thoughts on these changing conditions? Leave a comment below or tweet us @Staupell. [1] See One More Time by Carol Burnett, published 1986 by Random House.

[2] Watch the series, The Men Who Built America, produced by the History channel to feel the impact of what Rockefeller, Carnegie, and Ford did for our lives and our economy. [3] The Freakanomics Radio link will take you to the transcript of this show. [4] From my personal experience as a prospect researcher during these decades.

0 Comments

Leave a Reply. |

Keep Informed

|

Photos from jeffdjevdet, SMPAGWU